Food, Beverage and Tobacco Product Manufacturing Ontario: 2022-2024

Food, Beverage and Tobacco Product Manufacturing Ontario: 2022-2024

NAICS 311, 312

Download the PDF version (881 KB) of this content.

HIGHLIGHTS

- There were 120,492 people employed in the food, beverage and tobacco (FBT) products manufacturing subsector in Ontario, comprising 1.5% of Ontario's workforce in 2021.

- Employment in the province's subsector increased by 3.5% in 2021 from the previous year.

- Employment is expected to grow modestly over the 2022–2024 forecast period, though a high number of job vacancies, on top of persisting labour shortages, may temper growth.

- The province's food, beverage and tobacco products manufacturing subsector produced $14.5B in gross domestic product (GDP) in 2021, representing 17.8% of the overall manufacturing GDP in the province and 1.9% of Ontario's total GDP.

ABOUT THE SECTOR

Composition and importance of the sector

The food, beverage and tobacco products manufacturing subsector comprises establishments that produce food for human or animal consumption, and establishments that manufacture beverages and tobacco products.

In Ontario, this subsector employed 120,500 people in 2021, comprising 1.5% of the province's total workforce and 14.7% of total manufacturing jobs in Ontario. These workers accounted for more than one–third (37.0%) of employment in the food, beverage and tobacco products manufacturing subsector across the country.

The food, beverage and tobacco products manufacturing subsector in Ontario produced $14.5B in gross domestic product (GDP) in 2021, representing 17.8% of the overall manufacturing GDP in the province, or 1.9% of Ontario's total GDP.

Food, beverage and tobacco products manufacturing sales in Ontario totalled $52.5B in 2021, up 10.3% from the previous year. This accounted for 37.8% of total subsector sales in Canada. For reference, food, beverage and tobacco product sales nationwide were $138.9B, an increase of 15.0% from 2020.

Graph 1. Employment Share by Subsector

Source: Statistics Canada, Table 14-10-0392-01

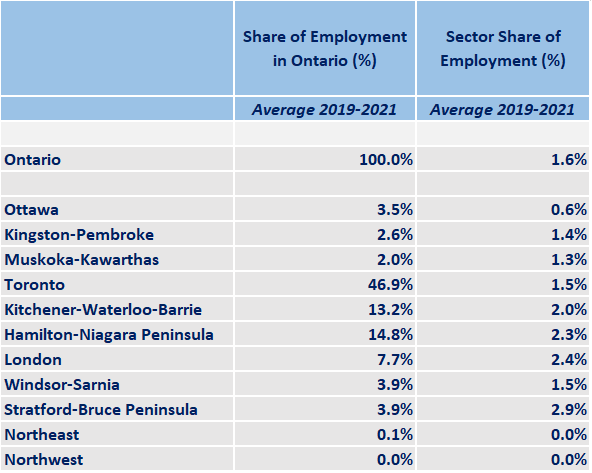

Geographical distribution of employment

The Toronto Economic Region (ER) accounted for the largest share of workers in food, beverage and tobacco manufacturing subsector in Ontario. Approximately 45.0% of workers in this subsector worked in the Toronto ER. However, proportionally, employment was high in the Stratford–Bruce Peninsula ER, where 2.5% of total employment was in this subsector, compared to 1.5% provincially. 2.5% of total employment in the London ER was also in this subsector.

Table 1. Employment by Economic Region

Source: Statistics Canada, Labour Force Survey

WORKFORCE

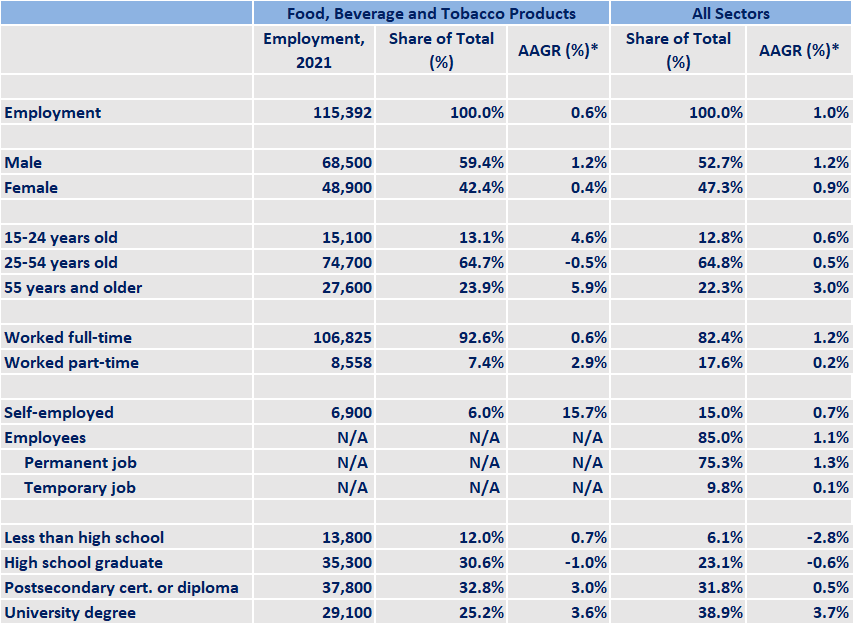

Workforce characteristics

- Women accounted for 41.7% of the food, beverage and tobacco products manufacturing subsector's workforce in Ontario in 2021, compared to 30.7% of the manufacturing sector and 47.3% in all industries.

- Youth (aged 15 to 24) made up 12.9% of the subsector's workforce in Ontario, compared to 8.6% of the manufacturing sector and 12.8% in all industries.

- 7.4% of employees in the food, beverage and tobacco products manufacturing subsector worked part–time, higher than the overall manufacturing sector (4.5%). However, in Ontario in all industries, 17.5% of workers were employed part–time in 2021.

- The average hourly wage rate in 2021 in Ontario's food manufacturing subsector was $23.24, below the provincial average of $26.84. Meanwhile, the average hourly wage rate for the beverage and tobacco products manufacturing subsector was $23.81.

Table 2. Top 5 Occupations

Source: Statistics Canada, Labour Force Survey

RECENT HISTORY

Since the onset of the COVID–19 pandemic, the food, beverage and tobacco products (FBT), manufacturing subsector was one of the few industries to have consistently performed well. Manufacturing sales and GDP for FBT manufacturing in Ontario rose steadily over the last ten years. Employment in Ontario's food, beverage and tobacco product manufacturing subsector totalled 135,300 in June 2019, pre–pandemic. In June 2022, when all mask mandates, travel restrictions and capacity limits were lifted, employment slightly declined to 117,400 (–13.2% from June 2019). This decline may have been due to consumers shifting preferences towards eating from home during the pandemic and back to eating out post–restrictions.

Businesses within this subsector were deemed essential during strict COVID–19 public health restrictions, meaning that manufacturers were able to remain open. Even so, numerous firms across the province experienced disruptions to their operations due to COVID–19 outbreaks at their workplaces, such as at the Cargill meat plant in Guelph and Belmont Meats in North York. However, overall, the industry remained strong, with sector sales actually increasing consistently since 2017, even through pandemic years 2020 and 2021.

Some of the growth through 2020 and 2021 can likely be attributed to an abrupt shift of consumption trends from food services to food retail, given restaurant capacity limits and closures. These restrictions led consumers to spend more on groceries, with some even to the point of stockpiling food and beverage products due to shortage fears.

Graph 2. FBT Employment, Sector Sales, Sector Gross Domestic Product (GDP) in Ontario

Source: Statistics Canada, Labour Force Survey

*Data are expressed as index where year 2012 = 100%

EMPLOYMENT OUTLOOKS

The outlook for food, beverage and tobacco products manufacturing is moderate for the forecast period, with expansion and growth potentially limited by labour shortages. High inflation may also change consumers' spending habits, also affecting the outlook of this subsector.

While Ontario's food, beverage and tobacco products manufacturing subsector was able to weather the economic downturns of the pandemic, COVID–19 has magnified the subsector's continued workforce challenges. As in many other manufacturing subsectors, food, beverage and tobacco products is experiencing hiring and retention issues in both higher–skilled roles and frontline production. Automation is in many manufacturers' plans; however, advanced automated production has not been adopted on a widespread scale and many processers continue to rely on lower wage employees. These labour supply challenges, exacerbated by the pandemic, will continue to threaten industry growth.

In Ontario, 90% of surveyed food and beverage manufacturers indicated intentions to pursue further automation and robotics technology within the next few years. Federal and provincial governments continue to support new and expanding food and beverage manufacturing facilities across Ontario, increasing production and creating new jobs in the subsector. For instance, the Government of Canada recently announced $6M in funds in July 2022 to Toppit Foods Ltd. to expand capacity at its plant in Brampton and create 60 jobs. In addition, the federal government committed funds to local businesses in Parry Sound–Muskoka in April 2022, including:

- $883,281 to Crofter's Food Ltd.,

- $241,000 to Legend Spirits Company, and

- $197,500 to Lake of Bays Brewing Company Limited.

At the provincial level, the Government of Ontario announced plans to invest up to a total of $24M to boost the province's food processing capacity through its new Strategic Agri–Food Processing Fund Program.

Moreover, rising inflation rates are also affecting consumers, as households grapple with increased living costs, including higher grocery and restaurant bills. These rising food prices were, at least in part, passed on to consumers from manufacturers and businesses due to higher input costs and supply chain disruptions. Consequently, a shift in consumer spending is emerging. A February 2022 poll found that four–in–five Canadians are changing their food buying habits, including 62% of respondents reporting eating out less, 25% cutting back on alcohol and 21% buying fewer fresh fruits and vegetables. These changes in consumption trends may temper performance in the FBT subsector, as the demand for certain products declines.

Table 3. Employment Change in Food, Beverage and Tobacco Products Manufacturing: June 2019 vs. June 2022

Source: Statistics Canada, Labour Force Survey

Key trends affecting the outlook of the sector

- High inflation affecting the cost of food and changing consumers' spending patterns.

- Investments in automation and technology.

- Labour shortages.

FOR FURTHER INFORMATION

Note: In preparing this document, the authors have taken care to provide clients with labour market information that is timely and accurate at the time of publication. Since labour market conditions are dynamic, some of the information presented here may have changed since this document was published. Users are encouraged to also refer to other sources for additional information on the local economy and labour market. Information contained in this document does not necessarily reflect official policies of Employment and Social Development Canada.

Prepared by: Labour Market and Socio-economic Information Directorate, Service Canada, Ontario Region

For further information, please contact LMSID at: Contact: Labour Market Information - Canada.ca (services.gc.ca)

APPENDIX

Table A1. Geographical Distribution and Employment Outlooks of the Sector

Source: Statistics Canada, Labour Force Survey

Table A2. Characteristics of Employed Persons

Source: Statistics Canada, Labour Force Survey

*Average annual growth rate for last ten years available data