Motor Vehicle, Body, Trailer and Parts Manufacturing (NAICS 3361-3363): Ontario, 2024–2026

HIGHLIGHTS

- There were 144,400 people employed in the Ontario motor vehicle, body, trailer and parts (MVBTP) manufacturing industry, comprising 1.8% of Ontario‘s total workforce in 2023.

- Employment in the MVBTP manufacturing industry increased by 14.0% in 2023 and is above pre-pandemic levels.

- Employment growth is expected to weaken in MVBTP manufacturing over the 2024-2026 forecast period.

- The shift to electric or hybrid vehicle production is generating mixed activities, with investments being made alongside layoffs in some motor vehicle and parts facilities as automakers retool their plants.

ABOUT THE SECTOR

The motor vehicle, body, trailer and parts (MVBTP) manufacturing sector is made up of the following subsectors:

- 3361 - Motor vehicle manufacturing (comprised of: 33611 - Automobile and light-duty motor vehicle manufacturing and 33612 - Heavy-duty truck manufacturing)

- 3362 - Motor vehicle body and trailer manufacturing

- 3363 - Motor vehicle parts manufacturing

Composition and importance of the sector

Ontario is the centre of MVBTP manufacturing in Canada: in 2023, it accounted for 81.7% of national employment in the sector and contributed 85.5% to the national MVBTP real Gross Domestic Product (GDP).

The MVBTP manufacturing industry is crucial to Ontario‘s economy, accounting for 16.4% of total manufacturing GDP and 1.8% of Ontario‘s total GDP. Despite a 32.2% increase since 2021, MVBTP GDP remains slightly below pre-pandemic levels (-4.7% less than in 2018).

Within the MVBTP group, motor vehicle production is the largest exporter, accounting for the leading share (24.7%) of the province‘s 2023 domestic export earnings.

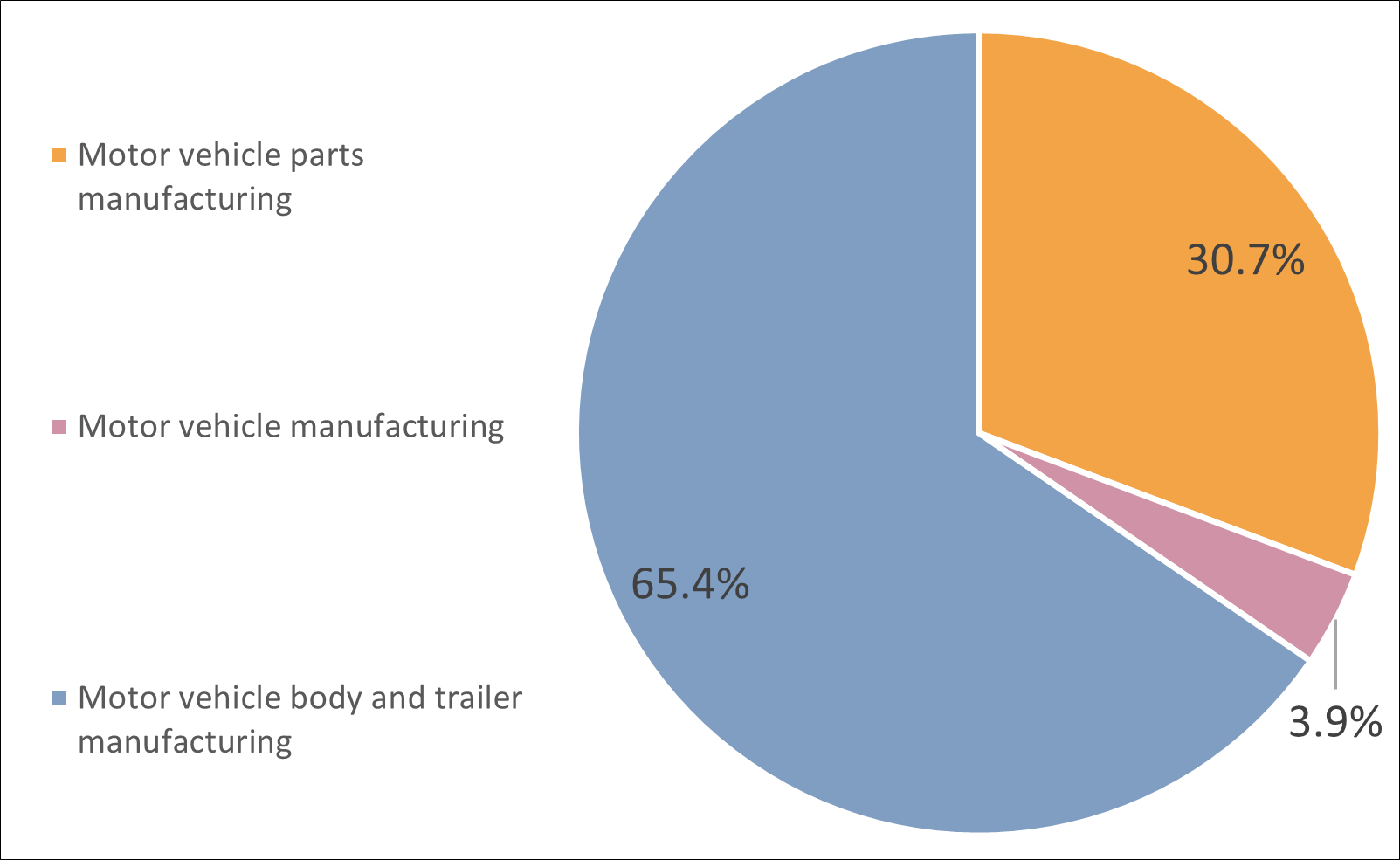

Graph 1. Employment Share by Subsector

Source: Statistics Canada, Labour Force Survey, Custom Table

Show graphic in plain text

Geographical distribution of employment

The MVBTP industry is dominated by five Original Equipment Manufacturers (OEMs) or motor vehicle manufacturers, operating eleven plants, mainly in southwestern Ontario. Below is a list of the OEMs and their plant locations in economic regions (ERs):

-

Ford Motor Company

- Oakville Assembly (Toronto ER)

-

General Motors Company

- CAMI Automotive-Ingersoll (London ER)

- Oshawa Assembly (Toronto ER)

-

Honda Motor Company

- Plant 1-Alliston (Kitchener-Waterloo-Barrie ER)

- Plant 2-Alliston (Kitchener-Waterloo-Barrie ER)

-

Stellantis

- Brampton Assembly (Toronto ER)

- Windsor Assembly (Windsor-Sarnia ER)

-

Toyota Motor Corporation

- Cambridge North Plant (Kitchener-Waterloo-Barrie ER)

- Cambridge South Plant (Kitchener-Waterloo-Barrie ER)

- West Plant Woodstock (London ER)

- Hino Motors Canada Woodstock (London ER)

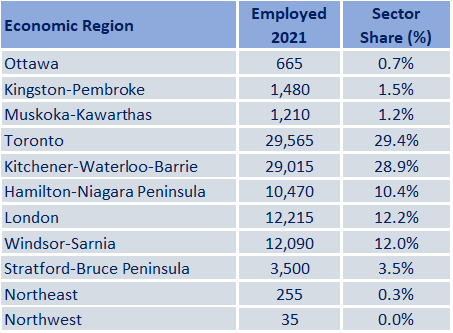

Table 1. Employment by Economic Region

Source: Statistics Canada, Labour Force Survey, Census 2021

Show table in plain text

WORKFORCE

Workforce characteristics

- Males accounted for approximately 73% of Ontario‘s MVBTP manufacturing workforce in 2023, compared to around 53% in all industries provincially.

- Older workers aged55 years and over represented a quarter (24.7%) of Ontario‘s MVBTP workforce in 2023, compared to 21.8% of workers across all industries in Ontario.

- Almost all workers in Ontario‘s MVBTP sector are employed full-time. In 2023, full-time employment accounted for 98.5% of total employment in MVBTP in Ontario, compared to 82.7% of total provincial employment.

- Average weekly earnings for MVBTP in Canada were $1,353 in 2023, higher than overall manufacturing nationally ($1,311).

Table 2. Top 5 Occupations

Source: Statistics Canada, Labour Force Survey, Custom Table

Show table in plain text

RECENT HISTORY

In 2023, employment in the MVBTP manufacturing sector increased by 14.0% (+17,700) and is 8.8% (+11,700) above pre-pandemic employment levels. This trend of overall employment growth has continued into 2024, as employment increased by 2.0% (+2,900) by June 2024. In comparison, overall manufacturing employment in Ontario increased by 2.7% in 2023.

Following a prolonged slump due to the COVID-19 pandemic, Canadian total light vehicle sales are finally recovering, mostly on the strength of light trucks. Comparatively, sales of passenger cars remain below pre-pandemic levels as high vehicle prices and the increased cost of financing moderate consumer demand. In terms of motor vehicle production levels, Canada recorded a significant improvement in 2023, driven by supply chain improvements as lockdowns were lifted and the semiconductor shortage eased. However, the ongoing retooling of automotive plants in Ontario is currently affecting vehicle production; Canadian motor vehicle production is down 10.5% in July 2024 from the same month in 2023.

Overall, Ontario‘s automotive sector is at a pivotal point as it focuses on meeting the national target for sales of zero-emission vehicles (ZEVs). ZEV sales in Canada attained an all-time high in share of new vehicle registrations (13.4%) in the second quarter of 2024. This shift from traditional gas vehicles to electric is having a significant impact on motor vehicle manufacturing, and also rippling through the supply chain and other areas of the economy. For example, automakers are ramping up their investments in the transition from internal combustion engine (ICE) vehicles to ZEVs and are at various stages in retooling their plants. Currently, these plant upgrades are resulting in layoffs at Ford, General Motors and Stellantis automotive production facilities and feeder plants.

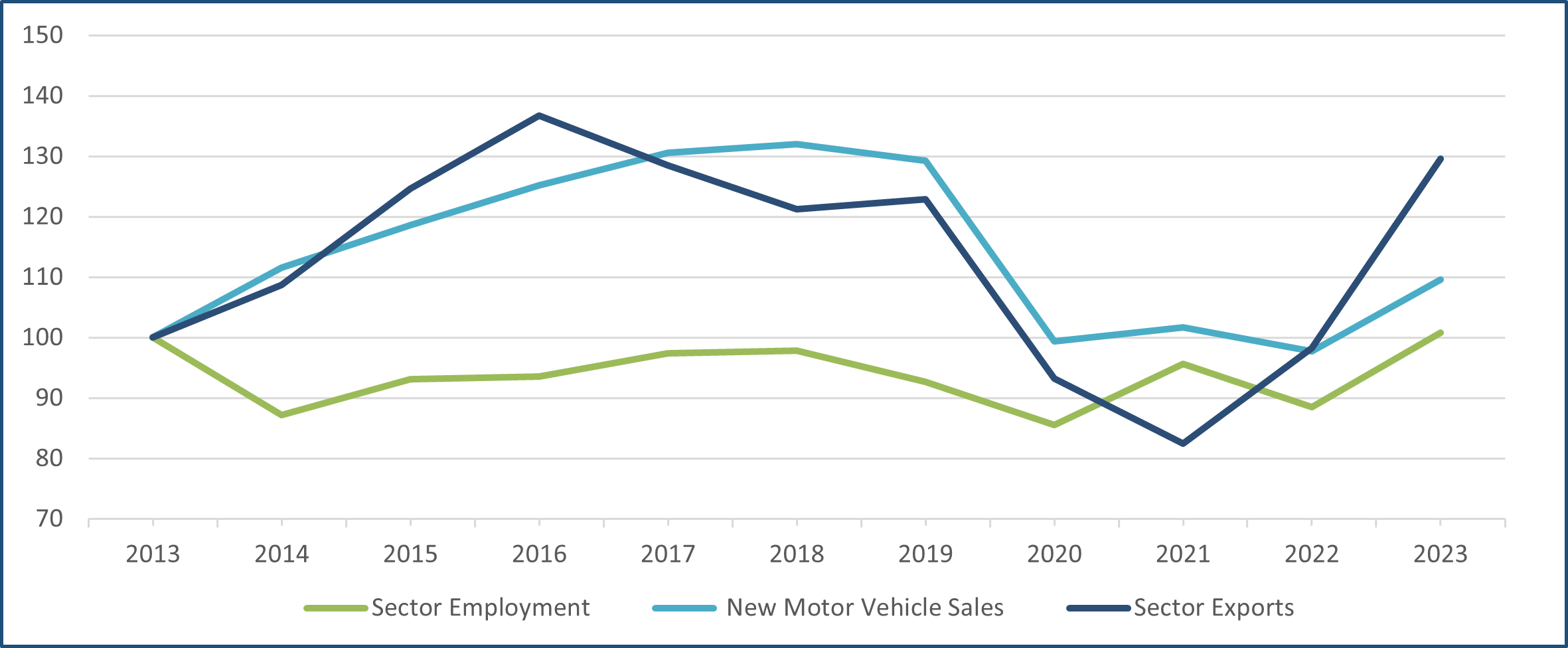

Graph 2. Sector Employment, New Motor Vehicle Sales, and Sector Exports

Sources: Statistics Canada, Custom Tables

*Data are expressed as index where year 2013 =100%

Show graphic in plain text

EMPLOYMENT OUTLOOKS

The MVBTP manufacturing industry is expected to experience a general weakening in employment over the 2024-2026 forecast period. Production workers in automotive and parts manufacturing are expected to be most at risk of layoff as motor vehicle manufacturing facilities transition to EVs, due to the demand for a different skillset compared to traditional automotive manufacturing. Since EVs require far fewer parts than ICE vehicles, the number of pieces assembled in motor vehicle manufacturing facilities is also expected to decrease, further impacting employment demand. However, workers‘ degree of exposure to layoffs and other changes will likely depend on whether they have union representation.

On the other hand, the province has attracted large-scale investments in battery and related plants, including NextStar Energy's battery manufacturing plant in Windsor, PowerCo's (subsidiary of Volkswagen) battery cell gigafactory in St. Thomas, and Honda‘s plans for EV production in Alliston. These projects and additional capital investments for retooling the automotive industry are expected to secure thousands of manufacturing jobs in Ontario‘s EV supply chain. Across the border, large investments in assembly plants in Michigan are expected to create work for parts suppliers and mold makers in the Windsor-Sarnia and London regions.

At the same time, EV production is resulting in new business synergies between automotive manufacturing and the metal ore mining sector, in light of the need for critical mineral inputs such as cobalt, lithium, and nickel for the batteries used in EVs. Among the other spillover effects, collaboration between the province, post-secondary institutions, industry associations and businesses is ongoing, as new programs and courses are launched to meet the unique needs of Ontario‘s EV value chain.

Key trends affecting the outlook of the MVBTP manufacturing sector

- Closures and consolidation at some automotive parts facilities and mass layoffs at several automotive assemblers

- Investments to retool plants to transition to EV production set to rollout in the near term

- Changing skills requirements for some roles in order to assemble ZEVs compared to ICE vehicles

FOR FURTHER INFORMATION

Note: In preparing this document, the authors have taken care to provide clients with labour market information that is timely and accurate at the time of publication. Since labour market conditions are dynamic, some of the information presented here may have changed since this document was published. Users are encouraged to also refer to other sources for additional information on the local economy and labour market. Information contained in this document does not necessarily reflect official policies of Employment and Social Development Canada.

Prepared by: Labour Market and Socio–economic Information Directorate, Service Canada, Ontario Region

For further information, please contact LMSID at: Contact: Labour Market Information – Canada.ca (services.gc.ca)

APPENDIX

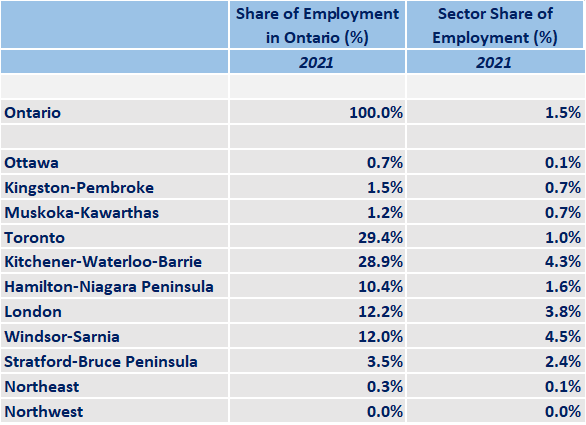

Table A1. Geographical Distribution of the Sector

Source: Statistics Canada, Labour Force Survey, Custom Table

Show graphic in plain text

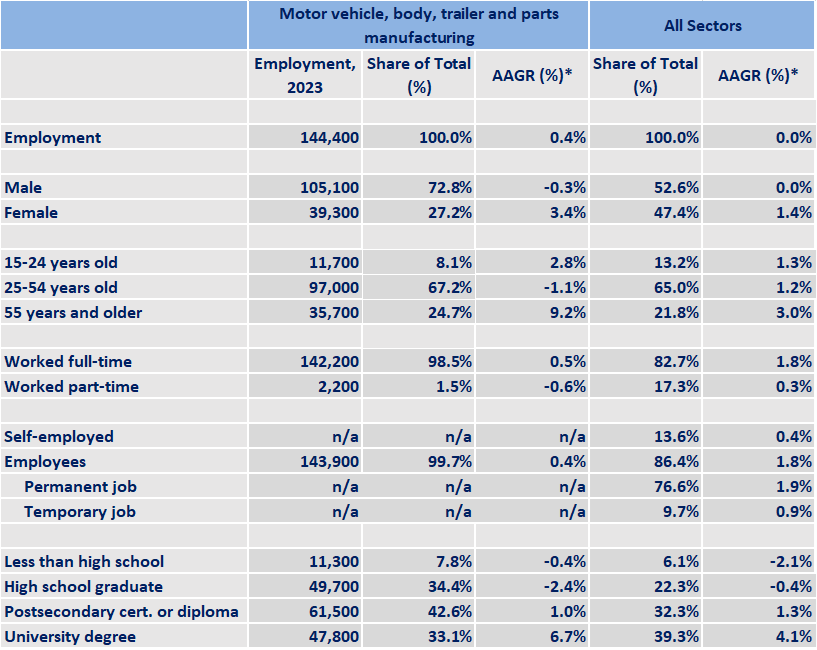

Table A2. Characteristics of Employed Persons

Sources: Statistics Canada, Labour Force Survey, Custom Tables

* Average annual growth rate for last ten years available data

Show table in plain text

| Motor vehicle, body, trailer and parts manufacturing | All Sectors | |||||

|---|---|---|---|---|---|---|

| Employment, 2023 | Share of Total (%) | AAGR (%) * | Share of Total (%) | AAGR (%) * | ||

| Employment | 144,400 | 100.0% | 0.4% | 100.0% | 0.0% | |

| Male | 105,100 | 72.8% | -0.3% | 52.6% | 0.0% | |

| Female | 39,300 | 27.2% | 3.4% | 47.4% | 1.4% | |

| 15-24 years old | 11,700 | 8.1% | 2.8% | 13.2% | 1.3% | |

| 25-54 years old | 97,000 | 67.2% | -1.1% | 65.0% | 1.2% | |

| 55 years and older | 35,700 | 24.7% | 9.2% | 21.8% | 3.0% | |

| Worked full-time | 142,200 | 98.5% | 0.5% | 82.7% | 1.8% | |

| Worked part-time | 2,200 | 1.5% | -0.6% | 17.3% | 0.3% | |

| Self-employed | n/a | n/a | n/a | 13.6% | 0.4% | |

| Employees | 143,900 | 99.7% | 0.4% | 86.4% | 1.8% | |

| Permanent job | n/a | n/a | n/a | 76.6% | 1.9% | |

| Temporary job | n/a | n/a | n/a | 9.7% | 0.9% | |

| Less than high school | 11,300 | 7.8% | -0.4% | 6.1% | -2.1% | |

| High school graduate | 49,700 | 34.4% | -2.4% | 22.3% | -0.4% | |

| Postsecondary cert. or diploma | 61,500 | 42.6% | 1.0% | 32.3% | 1.3% | |

| University degree | 47,800 | 33.1% | 6.7% | 39.3% | 4.1% | |